Aadhar Pan Link Mandatory : Need To Link Aadhaar Card With Pan Here Are Ways To Do It / For those who are yet to link their pan(pan card) with aadhaar, there is good news for them as the deadline has been extended till june 30.

Aadhar Pan Link Mandatory : Need To Link Aadhaar Card With Pan Here Are Ways To Do It / For those who are yet to link their pan(pan card) with aadhaar, there is good news for them as the deadline has been extended till june 30.. It has also made it mandatory to furnish aadhaar for filing income tax returns (itr). Certain class of people is exempted from linking aadhar card with pan card. The income tax department has made it mandatory for citizens to link their pan card with aadhaar before the deadline ends. Also while issuing a verdict that upheld the constitutional validity of aadhaar in september. The earlier deadline to link the pan card with the aadhaar card was september 30, 2019.

Section 139 aa (2) of the income tax act says that every person having pan as on july 1, 2017, and eligible to obtain aadhaar, must intimate his aadhaar number to the tax authorities. It is mandatory to link your pan with aadhaar by the end of this year, the income tax department said in a public message on sunday. The income tax department has made it mandatory for citizens to link their pan card with aadhaar before the deadline ends. Section 139 aa of the income tax act states that every person who has pan is required to link it with aadhaar failing which the pan card will become invalid. The linking has been done to come hard on unaccounted money and income by getting weed out the duplicate pan cards held by some persons in the country.

Passed the finance bill, 2021 on thursday, a new amendment has created problems for the.

According to the central board of direct taxes (cbdt) press release dated march 31, 2019, the deadline to link pan with aadhaar has been extended to september 30, 2019. D) a pop up window will appear, prompting you to link your pan with aadhaar. Last date is 31st march,2020. Let us know how to link the aadhaar card to the pan. It is mandatory to link your pan with aadhaar by the end of this year, the income tax department said in a public message on sunday. In the 2017 budget, the union government made it mandatory to link every individual's aadhaar with pan. The government of india has added a new section 234h into the income tax act 1961. There were several people that claimed that aadhaar pan link should not be made compulsory because aadhaar is not constitutionally valid. The government extended the deadline of linking pan with aadhaar by nine months, i.e., from june 30, 2020, to march 31, 2021. The linking has been done to come hard on unaccounted money and income by getting weed out the duplicate pan cards held by some persons in the country. Also while issuing a verdict that upheld the constitutional validity of aadhaar in september. Supreme court has given the nod to the pan aadhaar link. Certain class of people is exempted from linking aadhar card with pan card.

The government, earlier, has made mandatory for the aadhaar pan link. Based on the information, i suggest if. Aadhar card and pan card linking was declared compulsory by july 1st, but not everyone needs to do it. Taking steps in this direction, the government has made it mandatory to link the aadhaar card with the pan card. The deadline for linking pan to aadhaar has been extended to december 31, 2019.

The income tax department has made it mandatory for citizens to link their pan card with aadhaar before the deadline ends.

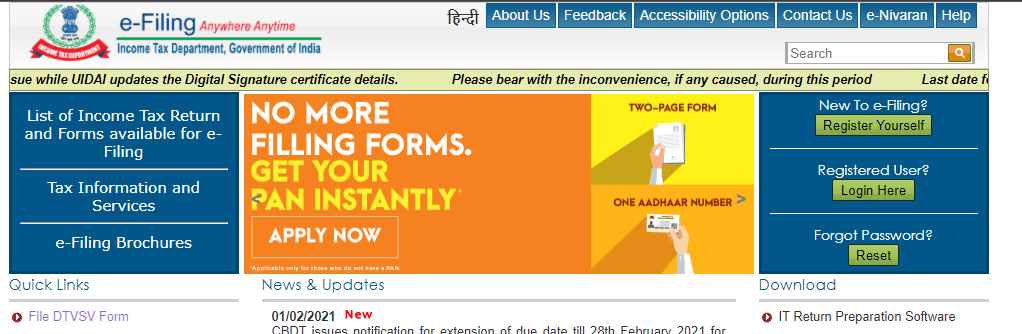

Yes, you should link yor pan card in your bank account which already have your aadhaar card even, if you are not filing itr. To make sure that your pan card is not declared inoperative by the income tax department it is mandatory to link it with aadhaar card within march 31 this year.the linking process is. For person having pan, linking of aadhar and pan is still mandatory for filing itr. The method of linking aadhar card with pan card is simple and completes with a few steps. D) a pop up window will appear, prompting you to link your pan with aadhaar. Based on the information, i suggest if. According to this new section, everyone has to link their aadhar card to their pan card. The last date to link aadhar with pan card is march 31, 2021. Name, date of birth and gender as per pan will be validated against your aadhaar details. Linkingaadhar with pan card is a mandatory process allowing a smooth process of income tax returns. If you want to file your income tax return linking pan to aadhar is mandatory. The government, earlier, has made mandatory for the aadhaar pan link. The government of india has added a new section 234h into the income tax act 1961.

The government extended the deadline of linking pan with aadhaar by nine months, i.e., from june 30, 2020, to march 31, 2021. Taking steps in this direction, the government has made it mandatory to link the aadhaar card with the pan card. Also, from april 1, 2019, it was made mandatory to quote and link aadhaar number while filing an income tax return (itr) unless specifically exempted. Read on to know the aadhar pan link last date. It has now become mandatory for you to link your pan with aadhaar with effect from july 1, 2017, as per the income tax laws.

Supreme court says linking pan with aadhaar is mandatory september 1, 2020 sumit kumar aadhar card the supreme court, in its judgement on the constitutional validity of aadhaar, has upheld the government's decision to linking pan with aadhaar.

Taking steps in this direction, the government has made it mandatory to link the aadhaar card with the pan card. If you want to file your income tax return linking pan to aadhar is mandatory. Section 139 aa of the income tax act states that every person who has pan is required to link it with aadhaar failing which the pan card will become invalid. To make sure that your pan card is not declared inoperative by the income tax department it is mandatory to link it with aadhaar card within march 31 this year.the linking process is. It has also made it mandatory to furnish aadhaar for filing income tax returns (itr). It has also been mandatory from april 1, 2019 to cite and link the aadhaar number while. Aadhar card and pan card linking was declared compulsory by july 1st, but not everyone needs to do it. The income tax department has made it mandatory to link aadhar card to pan card for tax purposes. The income tax department has made it mandatory for all citizens to link their pan card to the aadhaar card. How can i link aadhaar to income tax returns? If the pan is not linked with your aadhaar, then you may not be able to use the former for financial. According to the directive from the income tax department, it is obligatory to link your permanent account number (pan) with aadhaar. Section 139 aa (2) of the income tax act says that every person having pan as on july 1, 2017, and eligible to obtain aadhaar, must intimate his aadhaar number to the tax authorities.

Komentar

Posting Komentar